Millage Information

Special Education Millage

August 6, 2024

Clinton County RESA will place a Special Education Millage on the August 6, 2024, ballot. This ballot will include two components:

- Renewal: The renewal would continue taxes at the same rate as today for the next 20 years. The current millage expires December 31, 2024.

- Restoration: The proposed Headlee Restoration restores taxes to the original value approved by voters. This will increase current tax collection to 0.0517 mils for 20 years ($.0517 on each $1,000 of taxable valuation). If approved by voters, the proposed restoration would cost a homeowner approximately $5.17 per year for a home with a market value of $200,000 (with a taxable value of $100,000)

Students receive special education services as a requirement under The Rehabilitation Act of 1973 which states all students have access to a Free and Appropriate Public Education (FAPE).

Due to special education being underfunded by federal, state and local revenues, school districts pull funds allocated by the state for general education that supports all students to fill the gap in special education funding.

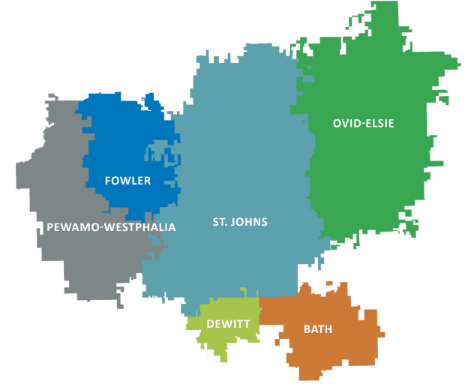

The proposed millage would apply to all taxable properties in the Clinton County RESA service area including Principal Residence Exemption (PRE) properties in the school district boundaries of Bath, DeWitt, Fowler, Ovid-Elsie, Pewamo-Westphalia and St. Johns.

Why Now?

Over 1,400 students in the Clinton County RESA service area receive Special Education services. This total includes students in Bath, DeWitt, Fowler, Ovid-Elsie, Pewamo-Westphalia and St. Johns.

Over the past 5 years, special education costs have gone from $6,537,896 in 2018-19 to $7,964,342 in 2022-23. This is an increase in costs of $1,426,446 or 21.8%.

The need for programs & services has increased and Clinton County RESA has been responsive to those needs. Examples include:

- A 25% increase in students receiving speech and language therapy from 2020-2022 requiring an increase in speech and language pathologists

- An increase in local district requests for behavioral supports which led to the development of a behavioral team.

- Specially designed training opportunities aligned with staff and district needs in areas such as curriculum, instructional strategies and student support strategies.

If the proposed millage does not pass, $873,448 will be lost and will impact all students in the service area. Due to federal requirements, local districts would have to use funds intended for general education, such as curriculum, athletics and other general education programming to fill the gap in funding.

What is the Cost to Homeowners?

This millage proposal includes a renewal at the same rate that would not increase current taxes and a Headlee Restoration which would increase annual taxes based (as outline below) on the taxable value of the home.

| Taxable Value of Residence | Projected Cost Per Year |

| $100,000 | $5.17 |

| $150,000 | $7.76 |

| $200,000 | $10.34 |

| $250,000 | $12.93 |

| $300,000 | $15.51 |

The renewal would continue taxes at the same rate as today for the next 20 years. The current millage expires December 31, 2024.

The proposed Headlee Restoration, restores taxes to the original value approved by voters. This would increase current tax collection of 0.0517 mils for 20 years ($.0517 on each $1,000 of taxable valuation), if approved by voters.

Which School Districts Are Covered Under This Millage Proposal?

The proposed millage would apply to all taxable properties in the Clinton County RESA service area including Principal Residence Exemption (PRE) properties in the school district boundaries of Bath, DeWitt, Fowler, Ovid-Elsie, Pewamo-Westphalia and St. Johns.

| Districts Served by Clinton County RESA |

Students |

| Bath | 121 |

| DeWitt | 298 |

| Fowler | 35 |

| Ovid-Elsie | 201 |

| Pewamo-Westphalia | 40 |

| St. Johns | 294 |

| Michigan International Prep | 132 |

| Clinton County RESA Programs | 231 |

| Non-Public Schools | 97 |

| Total |

1,449 |

What is a "Free and Appropriate Public Education - FAPE?"

According to the US Department of Education's website, there are requirements under Section 504 of The Rehabilitation Act of 1973 that "protects the rights of individuals with disabilities in programs and activities that receive federal financial assistance, including federal funds. Section 504 provides that: “No otherwise qualified individual with a disability in the United States . . . shall, solely by reason of her or his disability, be excluded from the participation in, be denied the benefits of, or be subjected to discrimination under any program or activity receiving Federal financial assistance."

This is commonly known as a Free and Appropriate Public Education or FAPE. More details are available regarding this act on the US Department of Education's website including:

- Who is entitled to a free appropriate public education?

- How is an appropriate education defined?

- How is a free education defined?

Which Special Education Needs are Served?

The following special education needs are served in pubic and non-public schools across the State of Michigan:

- Autism Spectrum Disorder

- Physical Impairment

- Cognitive Impairment

- Severe Multiple Impairment

- Deaf-Blindness

- Specific Learning Disability

- Deaf or Hard of Hearing

- Speech and Language Impairment

- Early Childhood Developmental Delay

- Traumatic Brain Injury

- Emotional Impairment

- Visual Impairment

- Other Health Impairment

Other Frequently Asked Questions

Q: What is on the ballot?

A: This proposed millage will include two components: a renewal and a Headlee Restoration, both for 20 years. The renewal would continue taxes at the same rate as today for the next 20 years. The current millage expires December 31, 2024. The proposed Headlee Restoration, restores taxes to the original value approved by voters. This would increase current tax collection of 0.0517 mils for 20 years ($.0517 on each $1,000 of taxable valuation), or $5.17 per year for a home with a taxable value of $100,000 ($200,000 Market Value).

Q: What is a Headlee Restoration?

A: In 1978, Michigan voters approved an amendment to the Michigan Constitution known as the Headlee Amendment. This amendment included a number of provisions related to state and local taxes, including those which support schools.

The state-created Headlee Amendment caps property tax increases at the rate of inflation. When the taxable values of properties rise faster than the rate of inflation, the actual tax levy is rolled back. As a result of a Headlee Rollback, schools collect less revenue than originally approved by voters.

Q: What is a millage?

A: Intermediate School Districts, also known as Regional Educational Service Agencies, levy special education millages to pay for the special education services they provide directly or that they pay other school districts to provide. This is in the form of a percentage per $1,000 taxable home value.

Q: Why is this on the ballot under Clinton County RESA if the funds would support students in all the local districts?

A: Clinton County RESA is the only educational entity in Clinton County that can place this proposal on the ballot and is doing so on behalf of, and with the cooperation with, the local school districts.

CCRESA provides direct special education services, including speech, occupational therapy, ASD programs, transportation, adaptive technology and more to local districts as well as distributes funds to local districts to support special education services.

Q: How would districts use the funds collected from this millage?

A: If approved, this restoration would generate special education funds to support students, purchase equipment, and decrease the amount of general education funds that are being used to supplement special education costs. In the Clinton County RESA service area, over 1,400 students receive special education services.

Q: Why are additional funds needed?

A: Costs continue to rise for special education programs and services provided in the CCRESA service area. This millage would not fully fund special education. However, it would reduce the amount that is being used from general education to fund special education requirements.

Q: Why are general education funds being used to pay for special education?

A: Local school districts are mandated by law through a Free and Appropriate Public Education to provide special education programs and services; however, federal and state governments have not adequately funded special education in the past, placing the burden on local and intermediate school districts. Without additional millage funds, local school districts would use general education funds to pay for special education programs and services.

Q: Who can vote in this election?

A: Every registered voter who lives in the school district boundaries of Bath, DeWitt, Fowler, Ovid-Elsie, Pewamo-Westphalia and St. Johns.

Q: When do I vote?

A: On August 6, 2024 or by absentee ballot.

Q: Where can I find out more information about voting?

A: The State of Michigan Secretary of State’s office has a Voter Information website for more details.